As we approach the four-year mark since the beginning of COVID-19, the global landscape has transformed into the ‘new normal’. Nowhere is this evolution more pronounced than in South Korea, where technology and online platforms have taken central roles. As businesses increasingly seek entry into this dynamic market, it’s crucial to grasp the specificities that may pose challenges. Asiance, with a keen understanding of these dynamics, aims to explore the shifting consumer landscape and offer insights to help businesses navigate this new era.

A Tech-Savy Nation: South Korea’s Embrace of Online Platforms

The tech-forward orientation of South Korea is evident in various aspects, with the government allocating a substantial budget to technological advancements. Visitors to Korea are often amazed by the seamless integration of technology into daily life.

Korea’s Social Media Dominance: Understanding the Consumer Landscape

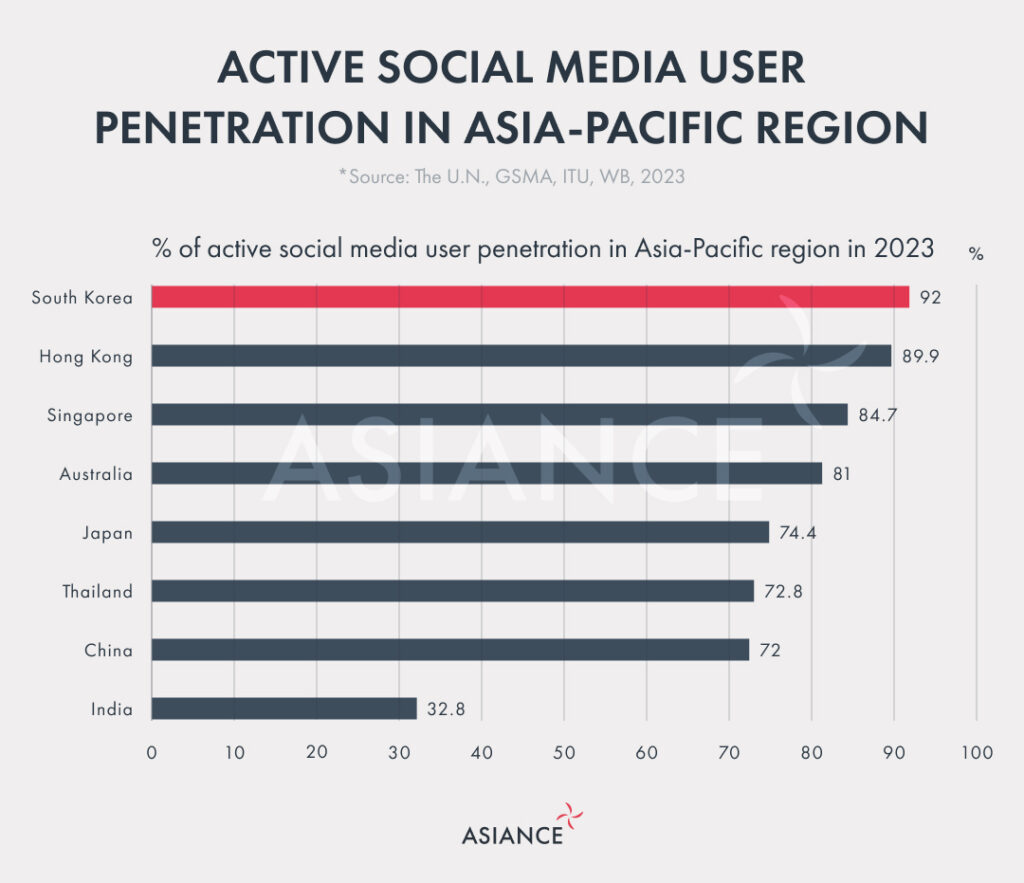

The evolving consumer landscape in South Korea is undeniably shaped by the omnipresent influence of social media platforms. Prominent players like Instagram, KakaoTalk, and Naver have become integral to the population’s daily life. Notably, South Korea has an outstanding social media penetration rate of 92%, the highest in Asia-Pacific.

This high social media penetration underscores the integral role that these platforms play in the daily lives of the South Korean population. From personal interactions to brand engagement, social media has become essential in the consumer journey. As individuals seamlessly integrate these platforms into their routines, businesses have a unique opportunity to leverage the power of social media for brand visibility, customer engagement, and marketing initiatives. Marketers from outside Korea often need clarifications on how local platforms function in the consumers’ daily lives. It is crucial for them to thoroughly explore these ecosystems to ensure that the integration within the company’s IT infrastructure aligns sensibly with the consumer journey.

Asiance, with its 20 years of expertise in digital marketing and consulting, is well-positioned to guide businesses through this dynamic landscape, ensuring that they harness the full potential of social media to connect with consumers in South Korea. Successfully penetrating the Korean market necessitates a strategic approach to social media that goes beyond mere content sharing. Social media, with its integrated e-commerce features, the influence of influencers, and the presence of taste-setter communities, plays a pivotal role in shaping consumer purchasing decisions.

Direct Customer Communication with Personalized Messages

Real-time communication on social media is a powerful tool for brands, enabling them to address consumer queries and concerns. This dynamic engagement fosters a connection with the audience and can increase return on investment (ROI). Asiance’s Software as a Service (SaaS) for personalized messages emerges as a valuable resource, facilitating efficient communication and ensuring brands reach their audiences effectively.

Influence and Taste-setter Communities

The omnipresence of influencers on South Korean social media platforms establishes them as powerful tastemakers, wielding significant influence over consumer choices in fashion, lifestyle, and product preferences. Besides, social media provides a platform for taste-setter communities, where individuals with similar interests and preferences gather. These communities wield significant influence over consumer choices. Asiance, recognizing the profound impact of influencer marketing, stands as a strategic partner, offering valuable insights to businesses aiming to align with influencers who resonate with their target market. We also help brands understand and engage with these communities.

Rise of Social Commerce

Social media has transcended its initial role as a platform for social interaction and has evolved into a thriving marketplace. The integration of e-commerce features within social media platforms has transformed them into dynamic marketplaces where users can discover, review, and purchase products. Asiance, with consulting service and new Software as a Service (SaaS) platform KPIBLE, guides brands in understanding the vast possibilities within platforms like Kakao and Naver.

E-commerce Evolution in South Korea: Breaking Age Barriers and Reshaping Retail Experiences

In South Korea, e-commerce has continuously grown since 2011, encompassing all age groups. The unique aspect of the Korean market lies in its early adoption of e-commerce opportunities, exemplified by the launch of Rocket Delivery in 2014, providing next-day delivery. Innovation in that field is continuous. Today, CJ Olive Young, a major player in the beauty product store franchise takes 45 minutes to deliver any products in the Seoul area.

Facilitators of E-commerce

While .com websites are less popular, online retail stores and Naver brand stores dominate e-commerce. Businesses entering or expanding in Korea need a digital transformation to cater to Korean consumers. We are here to guide you through this new digital ecosystem and transform your presence to tailor it for the Korean market.

Another facilitator of e-commerce has been the development of easy payment systems. The mobile payment market in the country is dominated by large non-bank technology companies such as Kakao, Naver, Toss, and Samsung Electronics. All services were launched between 2014 and 2015 and gained popularity as they simplified the payment process. A survey led by the Ministry of Sciences and ICT in Korea in 2022 indicated that out of 25,000 households, 63.8% used credit cards for payment while shopping online and 56.1% used mobile easy payment. Furthermore, this payment method is continuously growing. In 2022, the average daily value of mobile easy payment transactions approximated 732.6 billion Korean Won, while it reached only 64.52 billion in 2016.

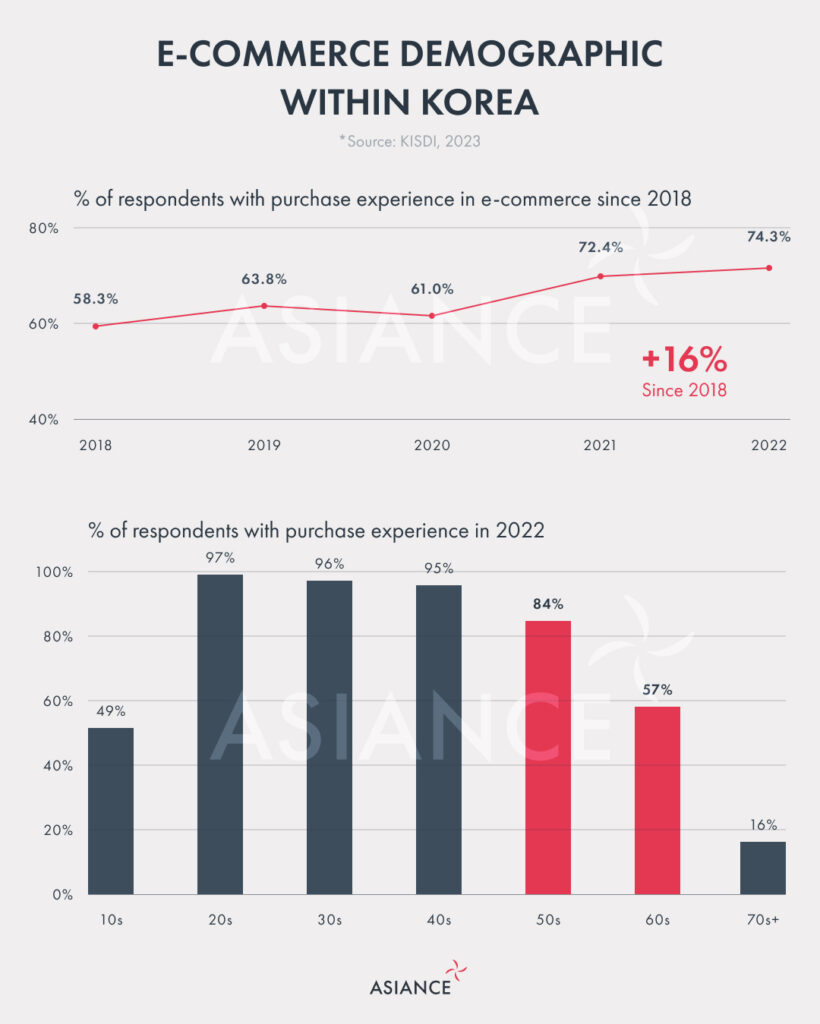

A phenomenon for all generations

In Korea, the typical age-based divide in e-commerce usage, often observed in other regions, is notably absent. Contrary to the common trend where younger generations dominate online shopping, consumers in their 50s and 60s in Korea also exhibit high rates of e-commerce engagement. The surge in online shopping is a phenomenon that transcends generational boundaries, impacting consumers of all age groups.

Supporting this observation, a comprehensive study conducted by the Korea Information Society Development Institute reveals compelling insights. 74.3% of respondents, spanning various age demographics, reported engaging in e-commerce purchases. This statistic underscores the influence of online shopping across all generations in Korea, bringing a fresh view to the belief that digital purchasing habits are confined to the younger population. This shift in consumer behavior not only reflects the accessibility and user-friendliness of online platforms but also highlights the adaptability of older generations to embrace and integrate e-commerce into their lifestyles. 84% of respondents in their 50s reported having engaged in online shopping experiences and 57% of respondents in their 60s indicated participation in online shopping activities during the same period.

The findings from this study emphasize the universality of the online shopping trend in Korea, making it imperative for businesses to tailor their strategies to meet the diverse needs and preferences of consumers across different age groups. As the digital landscape continues to evolve, understanding and leveraging the widespread acceptance of e-commerce among all generations in Korea becomes crucial for businesses seeking success in this dynamic market. Precisely, our agency positions itself as a partner for all businesses willing to start or expand their business in Korea.

Impact on traditional shopping

The surge in e-commerce has reshaped the retail landscape, prompting brick-and-mortar stores to undergo a process of reinvention to stay relevant and appealing to customers. Traditional offline stores are pivoting towards offering immersive experiences to clients, moving beyond the conventional display of available products. This transformation is especially evident in the growing popularity of pop-up stores and concept stores. Rather than merely showcasing products, these reimagined stores prioritize providing unique and engaging experiences for customers. Pop-up stores, in particular, have become a dynamic avenue for brands to connect with consumers temporarily, creating a sense of exclusivity and urgency. Concept stores, on the other hand, focus on creating a curated environment that aligns with the brand’s identity, offering customers a more personalized and memorable shopping experience.

Asiance, committed to providing its clients with leading insights, has conducted extensive research on the trends in pop-up stores within the luxury sector. If you are eager to dive deeper into this subject and gain valuable knowledge on the evolving landscape of luxury retail, you can access and purchase the comprehensive report on pop-up store trends directly from our website.

South Korea’s Dynamic Luxury Landscape: From Shifting Consumer Preferences to Online Shopping Trends

The evolving consumer landscape, particularly in the ‘new normal’ era, has witnessed a notable shift in consumer preferences from material goods to experience-oriented products. Numerous studies underscore this transformation, revealing that individuals are increasingly allocating larger portions of their budgets to products that offer unique and enriching experiences rather than traditional material possessions. South Korea, too, is actively participating in and contributing to this paradigm shift. In the midst of the ‘new normal,’ where the value of experiences has taken precedence, the South Korean consumer market reflects a heightened interest in allocating resources towards luxury products. Luxury items, often associated with premium experiences, are gaining prominence as individuals seek to enhance their lifestyles with products that go beyond mere functionality.

Navigating the Specificities of Korea’s Luxury Market

The luxury market in South Korea has witnessed continuous growth and evolution in recent years, positioning the country at the forefront globally. In 2023, Korea achieved the highest ranking in the world for per capita consumption of luxury goods, surpassing both the United States and China. This impressive statistic indicates a robust willingness among the Korean population to invest in and spend more on luxury items.

Luxury consumption and social values

The cultural context of luxury consumption in Korea is distinct from that of European Union countries. In Asian countries, including Korea, the consumption of luxury goods is closely tied to social values and status competition. However, the study by Naumova et al. highlights Korea’s unique focus on reputation and career achievements among consumers of luxury goods. Peer recognition and self-realization play a crucial role in shaping consumer preferences. The implications of these findings suggest that luxury brands aiming to succeed in the Korean market need to prioritize factors such as quality, service, information, and warranty. Additionally, the use of high-quality multimedia, effective digital PR, and superior service becomes imperative to retain consumers with developed high brand awareness.

Our expertise plays a pivotal role in guiding clients through the intricate landscape of cultural nuances that shape consumer behavior in Korea. Navigating the unique cultural aspects of a market is essential for businesses aiming to establish a meaningful and successful presence. As an experienced player in the digital marketing and consulting arena, we leverage our deep understanding of Korean culture to assist clients in tailoring their strategies effectively.

Luxury Appeal Across Ages

One noteworthy aspect of the Korean luxury market is its appeal across all generations. The interest in luxury goods spans diverse age groups, and a particular specificity lies in the consumption patterns of the younger generation, often referred to as MZ (Millennials and Generation Z). A case study conducted by Islam and Singh in 2020 shed light on the consumption behaviors of Korean university students, particularly those in their 20s. The study revealed an increased interest in fashion and luxury goods among this demographic. Notably, the factors influencing their purchase intentions were identified as brand awareness and the element of social contrast, emphasizing the significance of well-crafted storytelling and branding strategies to resonate with the younger generation’s preferences in the Korean market. Our expert marketing team helps brands navigate trends in Korean among various age groups to reach targeted audiences.

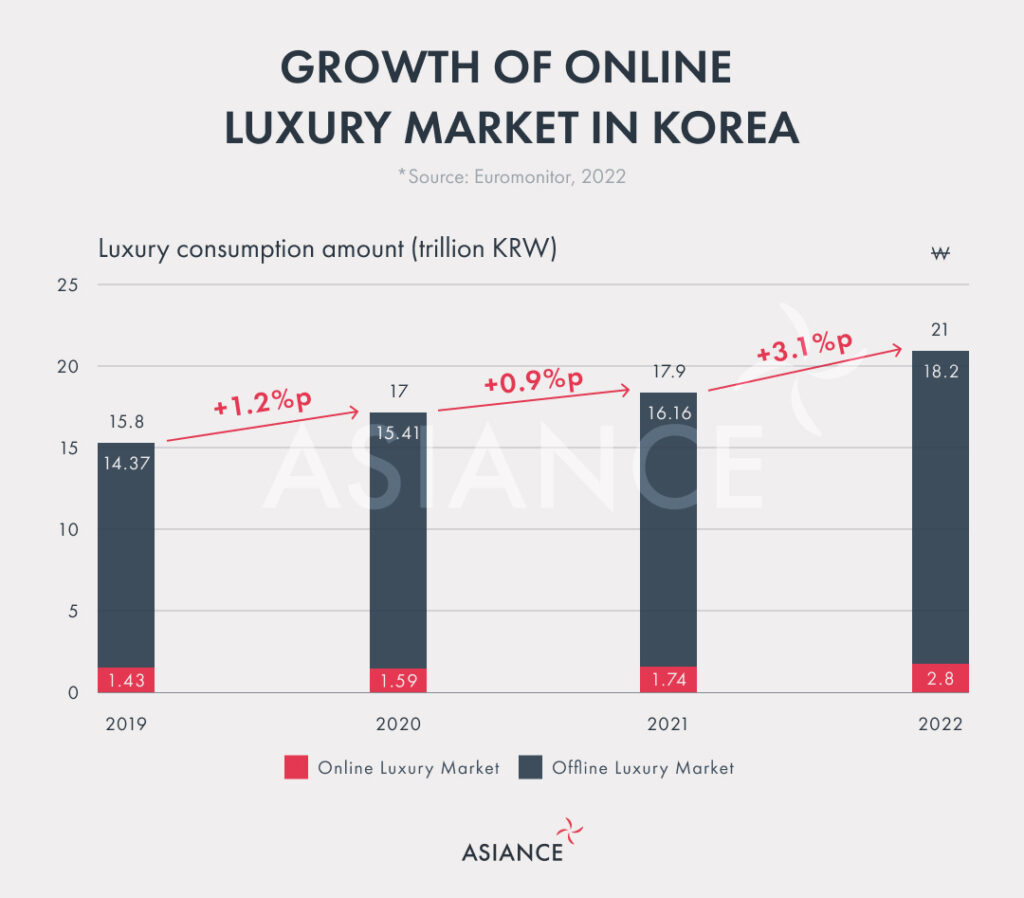

The Growth of Online Luxury: Redefining Consumer Patterns in Korea

Contrary to conventional beliefs, luxury consumption in Korea is not confined to brick-and-mortar stores. The online luxury market has experienced significant growth, showcasing a notable shift in consumer behavior. The online luxury market in Korea has expanded from 9.05% in 2019 to 13.3% in 2022. It underscores a noteworthy upward trajectory. While offline shopping for luxury goods remains a prevalent preference among Korean consumers, the continued surge in online luxury shopping is a trend that merits close examination. Remarkably, 30% of surveyed consumers reported using online platforms for luxury purchases, revealing a substantial market share.

Generational preferences

The transition towards online luxury shopping is accentuated within the younger generation, underscoring their adaptability and ease with digital platforms. A survey conducted by Asiance in 2023 on the last purchase channel for luxury goods, involving 800 participants, highlights distinct patterns across age groups. Teenagers emerged as the age group with the highest percentage of utilizing online sites for their luxury purchases, with a 50% preference for digital platforms. This statistic exemplifies the inherent digital fluency and preference for online shopping channels among younger consumers. In contrast, individuals over the age of sixty exhibited a strong inclination towards traditional offline stores, with 86.2% reporting their last luxury purchase through brick-and-mortar stores. This highlights a notable generational divide in the preferred channels for luxury shopping, with older demographics continuing to favor the in-person experience offered by physical stores.

Understanding these age-specific trends is crucial for businesses in the luxury sector. Tailoring marketing strategies and online experiences to resonate with younger consumers’ preferences, while simultaneously recognizing the significance of offline engagement for older demographics, can contribute to a well-rounded approach that caters to the diverse needs of consumers across age groups. As the luxury market evolves, this nuanced understanding becomes key to building successful and targeted marketing campaigns.

Digital technology and luxury shopping

The growing interest and demand for luxury goods online are exemplified by Kakao’s Lux feature. This platform serves as evidence of the shift towards online luxury shopping and the evolving consumer preferences in Korea. Kakao’s Lux feature, an innovative initiative, seamlessly integrates luxury shopping into the digital landscape. The platform facilitates convenient and secure online transactions and provides users with a curated and immersive experience. This convergence of technology and luxury retail indicates the growing convergence of the digital and luxury worlds. The Lux feature on Kakao caters to the changing dynamics of consumer behavior, particularly among those who value the ease and accessibility offered by online platforms. By bringing luxury brands into the digital realm, Kakao acknowledges and capitalizes on the shift towards online luxury shopping. They provide consumers with a tailored experience.

In an era where a significant portion of consumer engagement occurs in the digital realm, understanding and harnessing the dynamics of online communication is crucial for luxury brands. Our Software as a Service (SaaS) platform, KPIBLE, provides a solution, enabling brands to study and analyze valuable insights from Line and Kakao, two of the most widely used messaging applications in South Korea. As the digital landscape continues to evolve, This SaaS offers luxury brands a proactive approach to stay ahead of trends and connect with consumers. The integration of Line and Kakao insights empowers brands to optimize their online communication strategies, fostering stronger connections and enhancing their overall digital presence in the competitive luxury market.

Conclusive Thoughts

In the ‘new normal’ era, South Korea’s consumer landscape unfolds with a blend of challenges and opportunities. The intersection of technology, evolving consumer preferences, and cultural nuances create a dynamic environment that demands deep understanding. Asiance is positioned at the forefront of digital expertise. We are ready to guide businesses through this transformative period, fostering a thriving presence in the evolving market.

Considering the intricate dynamics of South Korea’s tech-savvy society is essential for businesses seeking success. We recognize the evolving role of technology ; particularly the influence of social media platforms and the surge in online luxury shopping. By staying aware of these shifts, businesses can seize unprecedented opportunities for engagement and growth.

Cultural nuances play a pivotal role in shaping consumer behavior. We stand as a guide, helping businesses decode the unique aspects that influence purchasing decisions in Korea. Whether it’s understanding the preferences of different age groups or the complexities of luxury consumption, we ensure that businesses are culturally intelligent.

In this transformative period, where adaptation is key, we offer more than just survival strategies. By synthesizing technology trends, consumer insights, and cultural understanding, we equip businesses with guidance and help them mobilize the necessary tools to flourish in the ‘new normal’.

Are you interested in our services? contact us at: info@asiance.com