Did you know that 1 out of 4 Koreans made their latest luxury purchase online?

The Luxury Consumer Research Report 2024 is an exclusive annual report by Asiance that uncovers trends in how Korean consumers learn about and buy luxury products. This year, Asiance conducted a survey on 800 consumers to analyze customer journeys and patterns during the pre-purchase, purchase, and post-purchase stages.

Report Objectives

- Discern patterns in the preferences and behaviors of Korean luxury consumers based on survey data.

- Provide unique insight into trending topics such as KakaoTalk Gift Shop and pop-up stores.

- Help readers understand what is important for brands to consider when targeting the South Korean luxury market in 2024.

Report Structure

The report structure follows the customer journey and this year integrates new specific trends: KakaoTalk Gift Shop and Brand Pop-up Stores.

- Pre-purchase: How do Koreans look for information about luxury brands and products before purchase?

- Purchase: How do Koreans purchase luxury goods?

- Online purchase: What online channels do Koreans use to buy luxury goods?

- KakaoTalk Gift Shop: Do Koreans purchase luxury goods from GiftX and LuX?

- Brand Pop-up Stores: How do Koreans learn about luxury pop-up stores?

Survey Demographics

Asiance gathered data through an online survey. We collected responses from 800 Korean consumers who have purchased at least one luxury item in 2023. Our sample has an equal gender distribution with a 50:50 ratio. It was also divided into six different age groups to allow for age comparisons: teens (3.9%), twenties (21.9%), thirties (21.9%), forties (21.9%), fifties (21.9%), and sixties and above (8.6%). Besides, those who had a monthly income of 3 to 9 million Korean won accounted for about 60% of the total sample.

Pre-Purchase

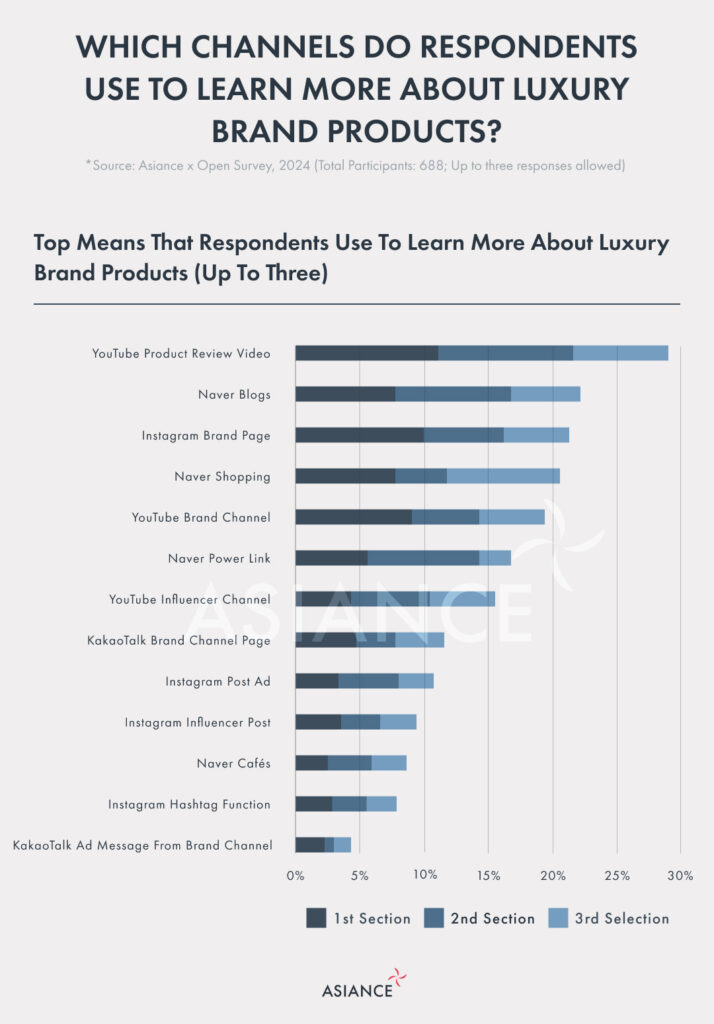

In the first section, we analyze the pre-purchase stage of the consumer journey. This means that we look at the channels used by consumers to learn about luxury brands and products. Results show that product review videos on YouTube are the most popular way to learn more about products. These videos are created by consumers who provide in-depth information about how the product looks and feels and how the product fits with trends and styles.

Purchase

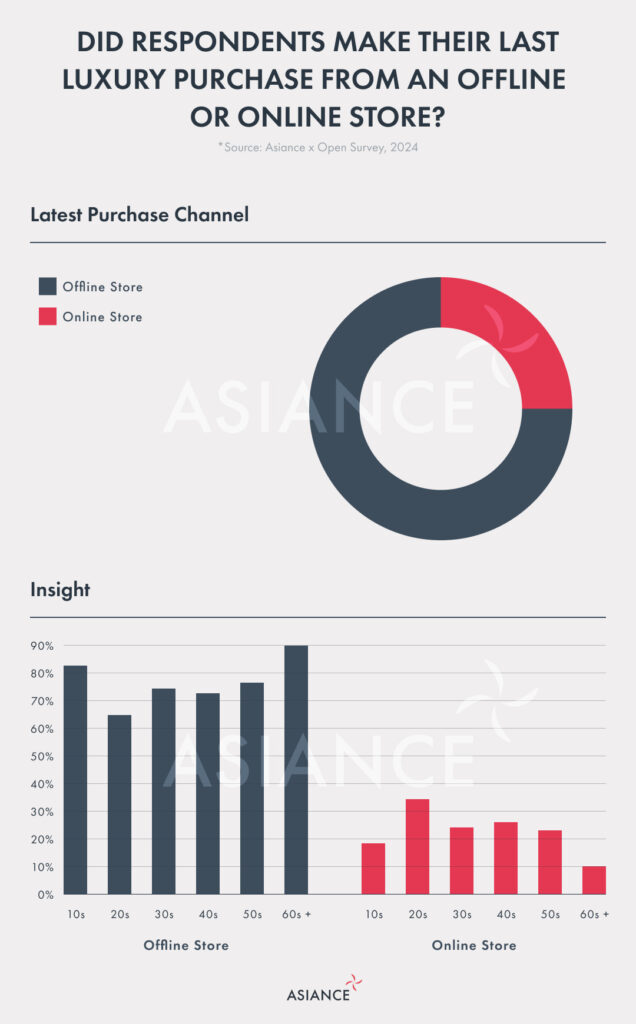

Then, we look into the preferred purchasing channels of consumers. This section also elaborates on factors influencing consumers to make a purchase. Last year, 25.9% of respondents made their last luxury purchase from an online channel. Online stores have become an increasingly popular channel for older respondents.

Online Purchase

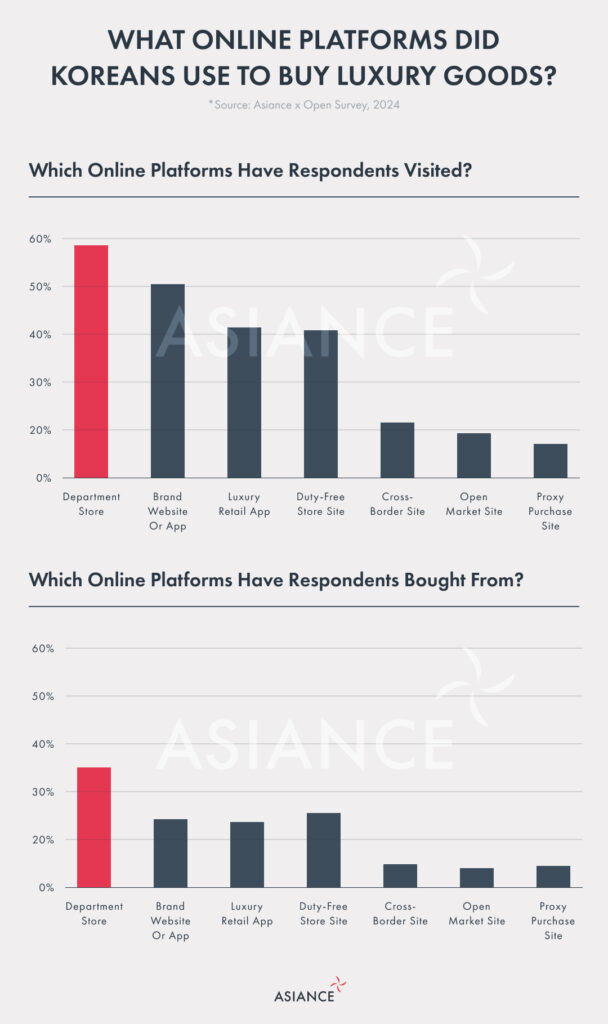

Given the high share of online purchases for luxury products compared to other countries, we decided to make an in-depth analysis of the devices and platforms used for online shopping. With this section, the reader understands the specificities of online shopping in Korea and the necessary sections to attract more customers. We found that the most widely used online platforms for buying luxury goods in 2023 were department stores, duty-free store websites, brand websites or mobile apps, and luxury retail apps.

KakaoTalk Gift Shop

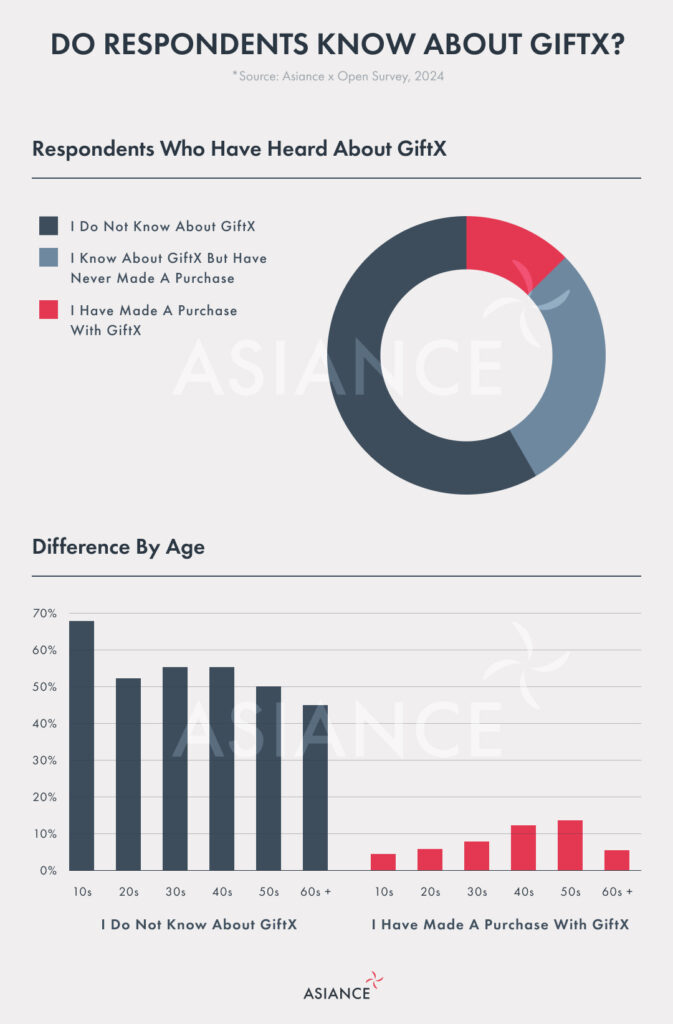

Due to the rising frequency of purchases from KakaoTalk Gift Shop, this section was added to the 2024 edition of the report. GiftX was launched in December 2022 and our survey highlights that 46.2% of the respondents have heard about GiftX. Among those who made a purchase on GiftX, those in their forties and fifties have the highest share.

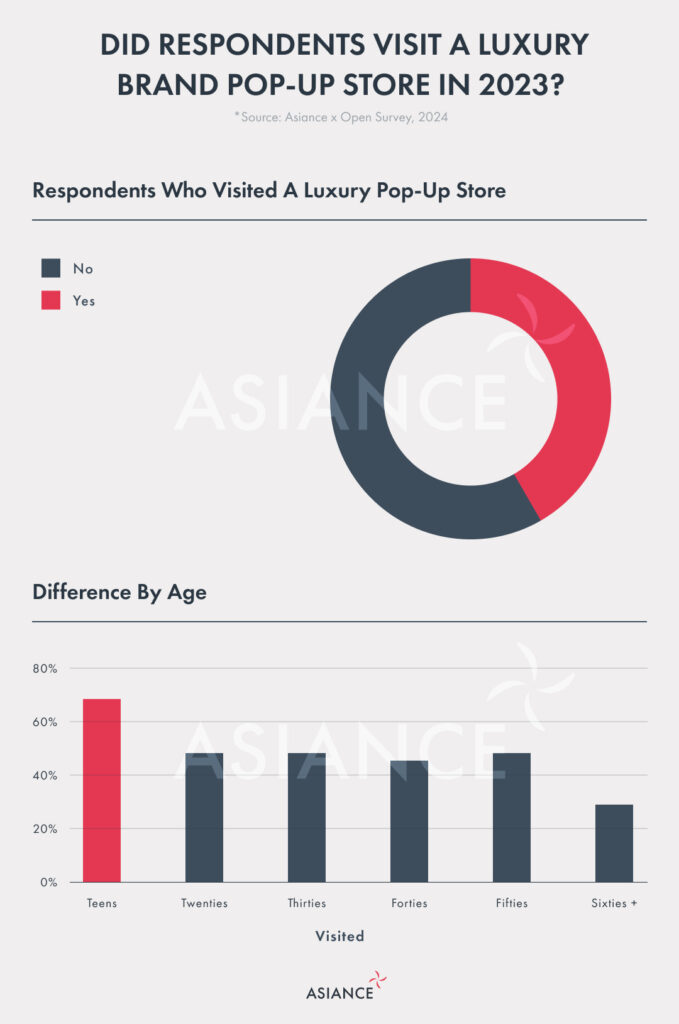

Brand Pop-up Stores

A staple trend of 2023 is the surge of pop-up stores. Indeed pop-up stores hosted by luxury brands have become popular and accessible means for learning about brands and products. This section explores which factors induce potential visitors to visit pop-up stores and which factors contribute to a satisfactory experience. In 2023 about 45% of respondents visited a pop-up store hosted by a luxury brand. Young consumers frequently visit pop-ups: 68% of respondents in their teens made at least one visit last year.

Download a preview version of the report through this link.

Contact us at insight@asiance.com to get your full Luxury Consumer Research Report 2024 today!