Asiance’s annual Luxury Consumer Research Report is back! Every year, Asiance conducts an exclusive study on Korean luxury consumers, providing crucial insights into their behavior and preferences. For 2025, the report has expanded its scope, surveying 1,000 respondents, a 25% increase from the previous year. Our in-depth insights give brands looking to tap into the dynamic South Korea luxury industry key takeaways to remain in touch with the latest consumer behaviours within this booming market.

After having researched the latest trends within the industry and planned the report’s direction and content, we formulated and set up a survey, focusing on consumer behaviors specific to the Korean luxury market by using a detailed questionnaire. After executing this survey, we gathered raw data on various aspects of consumer preferences and behaviors. The collected data was analyzed to identify key patterns and insights that revealed how Korean luxury consumers differentiate themselves. Finally, the findings were compiled into this polished report. Whether you’re working in the luxury business as a brand or a seller, or aiming to understand the distinct consumption habits of Korean luxury buyers, this report is a gold mine of information.

In this article, you’ll get a sneak peek into some highlights of our report. We’ve distilled key findings to give you a taste of the trends in Korean luxury consumption. While this preview offers valuable information, it doesn’t provide you with precise numbers, and only represents a fraction of the 140 pages of extensive data and analysis available our complete Asiance Luxury Consumer Research Report 2025. Contact us at insight@asiance.com if you wish to access the tangible results of our study!

REPORT STRUCTURE

The Asiance Luxury Consumer Research Report 2025 is structured into four comprehensive sections, each offering deep insights into different aspects of the Korean luxury consumer journey.

The Pre-Purchase : This section explores the information-seeking behavior of consumers before they make a purchase. It examines both offline and online sources of information, exploring why consumers might prefer one over the other. This section also investigates the social media channels that luxury consumers favor and assesses the impact of pop-up stores and events. By understanding what factors contribute to a satisfactory pop-up store experience, brands can better engage with their target audience.

The Purchase : We provide a detailed look at buying patterns and preferences. It covers the frequency and monetary value of luxury purchases, as well as the channels—both offline and online—that consumers prefer. The report investigates why consumers choose certain channels over others and identifies preferred local regions for luxury shopping. It also examines the key factors influencing purchase decisions and post-purchase considerations such as packaging and customer service. Additionally, this section explores the role of digital platforms like KakaoTalk Gift Shop in the luxury market.

Product Suite Diversification : This part analyzes consumer behavior regarding multi-category purchases from single brands, exploring the motivations behind such choices. It studies the popularity and perception of diffusion lines among Korean luxury consumers, providing valuable insights for brands considering product line expansions.

Digital Trends : Our report’s final section reflects the growing importance of digital engagement in the luxury sector. It covers various forms of digital content, from KakaoTalk emoticons to branded wallpapers, and examines consumer preferences in this area. The report also investigates the adoption and desirability of digital services such as Virtual and Augmented Reality shopping, as well as personalized recommendations. Lastly, it explores the use of Artificial Intelligence tools in online luxury shopping, offering a glimpse into the future of digital luxury retail.

This article will provide you one insight from the Pre-Purchase phase, two insights from the Purchase phase and one insight from the Product Diversification phase.

PRE-PURCHASE INSIGHT : OFFLINE BRAND EVENTS & POP-UP STORES

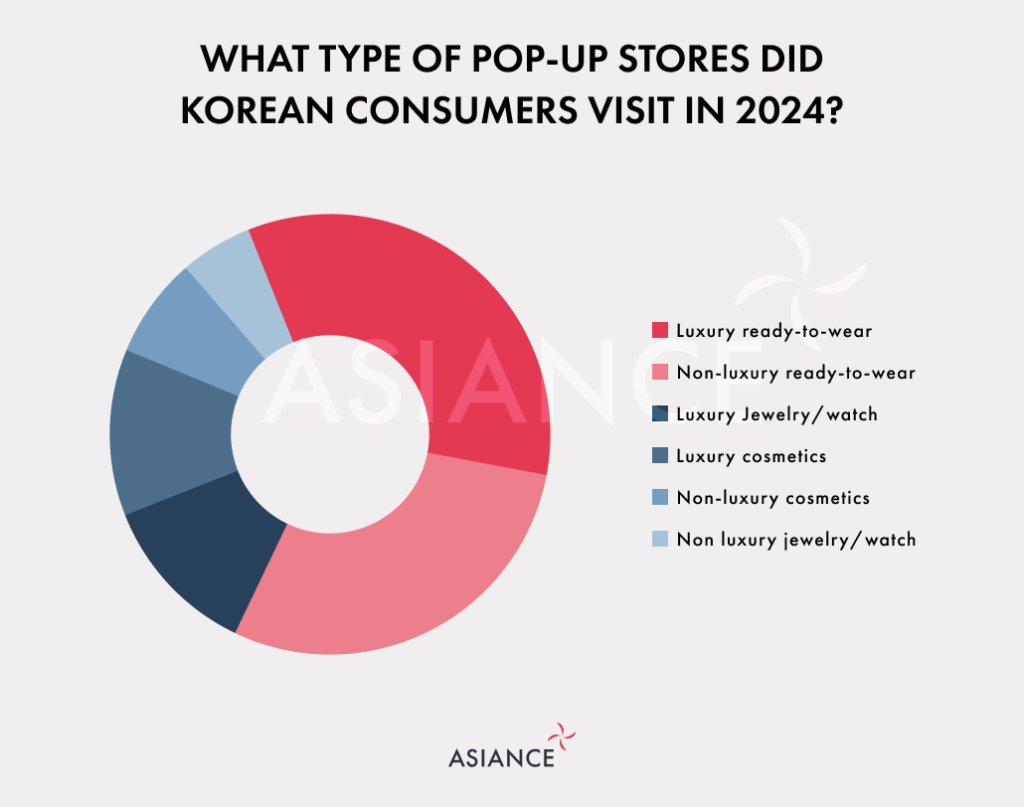

The report reveals that offline brand events and pop-up stores continue to play a significant role in consumer engagement. A striking two-thirds of consumers visited a pop-up store in 2024, with luxury ready-to-wear (RTW) pop-ups emerging as the most favored, although those dedicated to jewelry, watches, and cosmetics also attracted substantial attention.

PURCHASE INSIGHT : OFFLINE PURCHASE

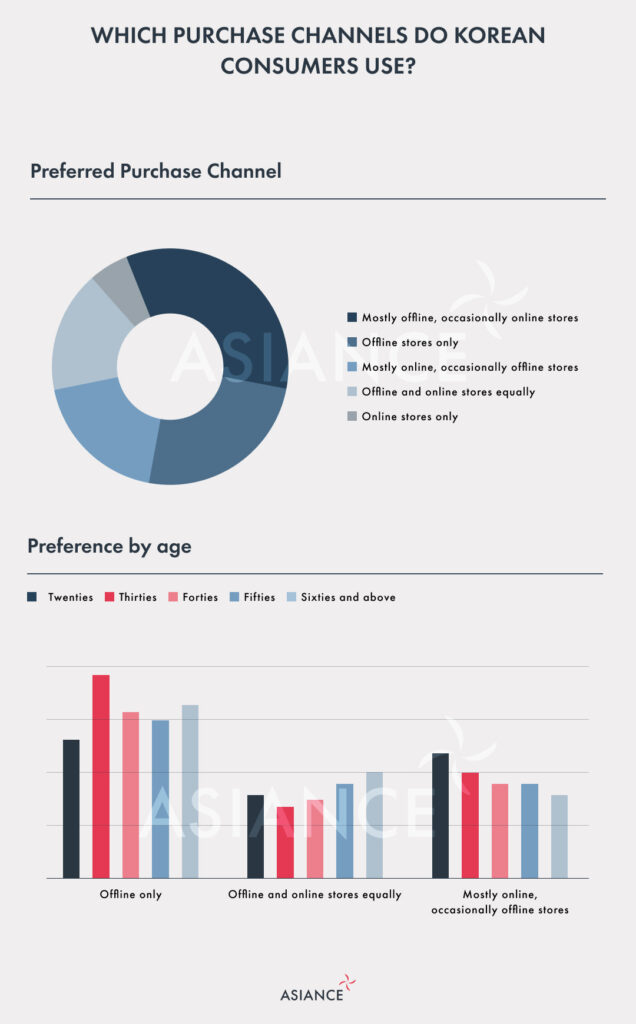

The purchase insights highlight an interesting trend in the Korean luxury market. While there’s a strong preference for offline stores, online channels are gaining traction, especially among younger consumers. While the majority of shoppers still favor offline purchases, a significant number lean towards online shopping, with a smaller group showing an equal interest in both offline and online options. Teenagers, in particular, are most likely to split their purchases between both channels, highlighting a shift in the shopping habits of the younger generation.

PURCHASE INSIGHT : ONLINE PURCHASE

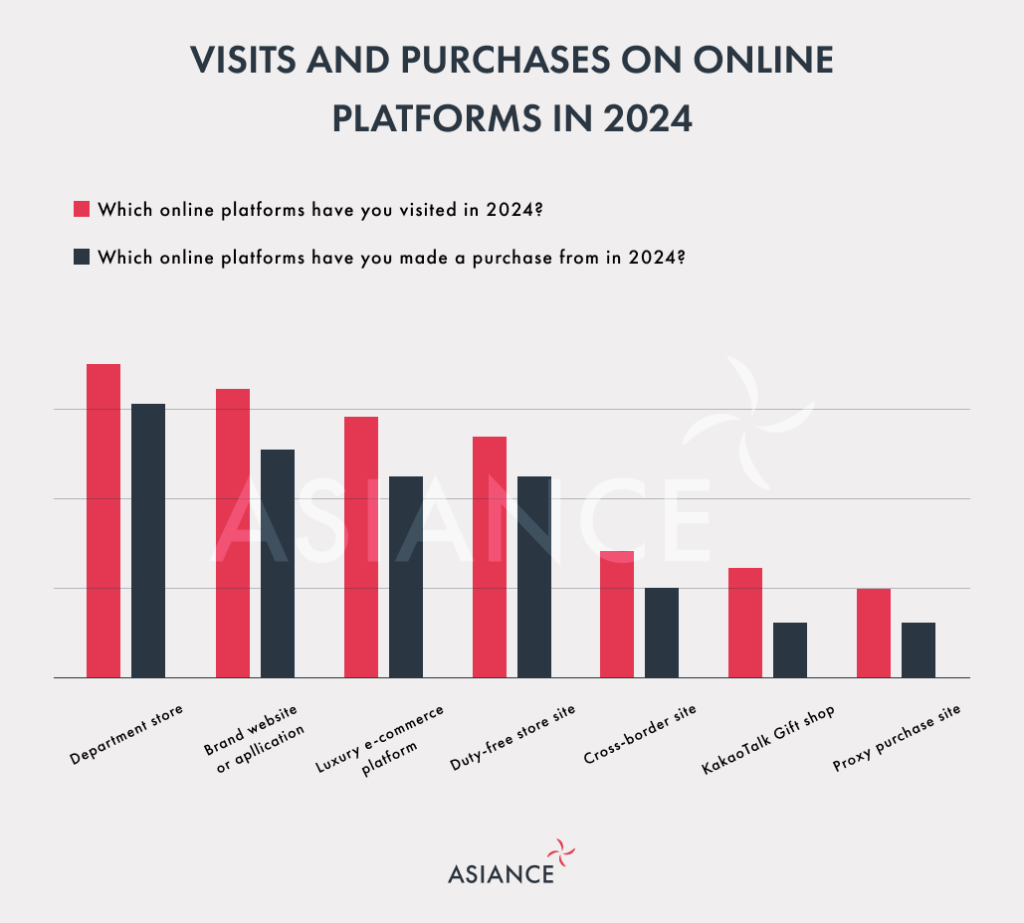

In the realm of online purchases, department store websites emerged as the most favored platforms. The top three platforms for online luxury purchases were department store online malls, brand websites or mobile applications, and e-commerce platforms.Throughout 2024, department store websites drew the largest number of visitors, with brand websites or apps coming in second, and luxury e-commerce platforms closely following. However, when it comes to actual purchases, department store websites maintained their lead, with brand websites or apps taking the second spot and e-commerce platforms securing third place. This trend highlights the significant role department stores continue to play in driving online luxury sales, while brand-specific sites and e-commerce platforms also remain important players.

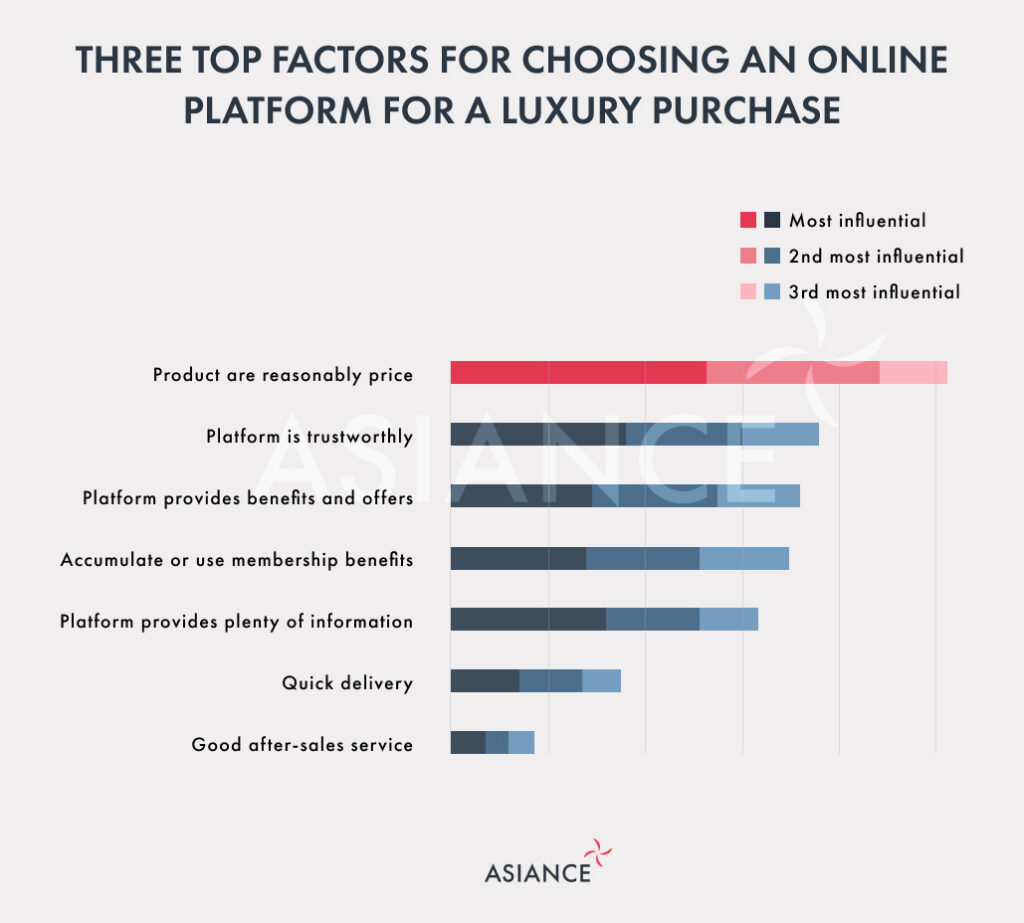

The report also sheds light on the factors influencing online platform choice.Reasonable pricing emerged as the most crucial factor, with a significant portion of consumers citing it as their primary reason for choosing a platform. Other influential factors included trust in the platform, as well as attractive benefits and offers that draw in customers. Additionally, the availability of detailed product information also played a crucial role in consumers’ decision-making processes, reinforcing the importance of transparency and value in the online shopping experience.

PRODUCT DIVERSIFICATION INSIGHT : DIFFUSION LINES

In terms of product diversification, the report explores consumer behavior towards diffusion lines. The top three most widely purchased diffusion lines were Emporio Armani, Comme des Garçons Play, and Hugo. Interestingly, almost half of consumers reported having purchased from a luxury brand’s diffusion line, indicating a significant market for these more accessible luxury offerings.

The full report serves as a wake-up call for luxury brands seeking to reach out to the next generation of Korean luxury consumers, offering them an in-depth understanding of their growing diversity and changing attitudes. With the market rapidly moving towards a combination of online and offline experiences, brands need to evolve their strategies accordingly to cater to the needs of this ever-evolving consumer segment.

You can download a preview version of this report here for free!

Access essential knowledge for your business and get Asiance Luxury Consumers Research Report 2025 by getting in touch with us at insight@asiance.com